32

www.globeasia.comT op Group s

5

Gudang Garam Group

Private

Cigarattes, palm oil, property, paper

Susilo Wonowidjojo

$ 7.5 billion

The Gudang Garam Group, Indonesia’s second-largest

tobacco manufacturer, is currentlymoving into other

businesses aside from cigarettes. Its property and

plantation businesses are growing significantly. The

Wonowidjojo family plans to complete the construction

of a privately owned airport with a 3,000-meter

runway in Kediri, East Java, before the end of next

year. The group also has significant interests in energy,

pulp and paper and property. The family controls

its palm oil plantation business through Matahari

Kahuripan (Makin Group), which has more than

130,000 hectares in Sumatra and Kalimantan. The

group produces specialty papers and packaging for

its cigarettes, while PT Surya Madistrindo is the sole

distributor of the company’s products. The group owns

Gudang GaramTower in Jakarta and other residential

and hotel projects in East Java and Bali.

7

Lippo Group

Private

Property, retail, healthcare, education, media, e-commerce

Mochtar Riady

$7.0 billion

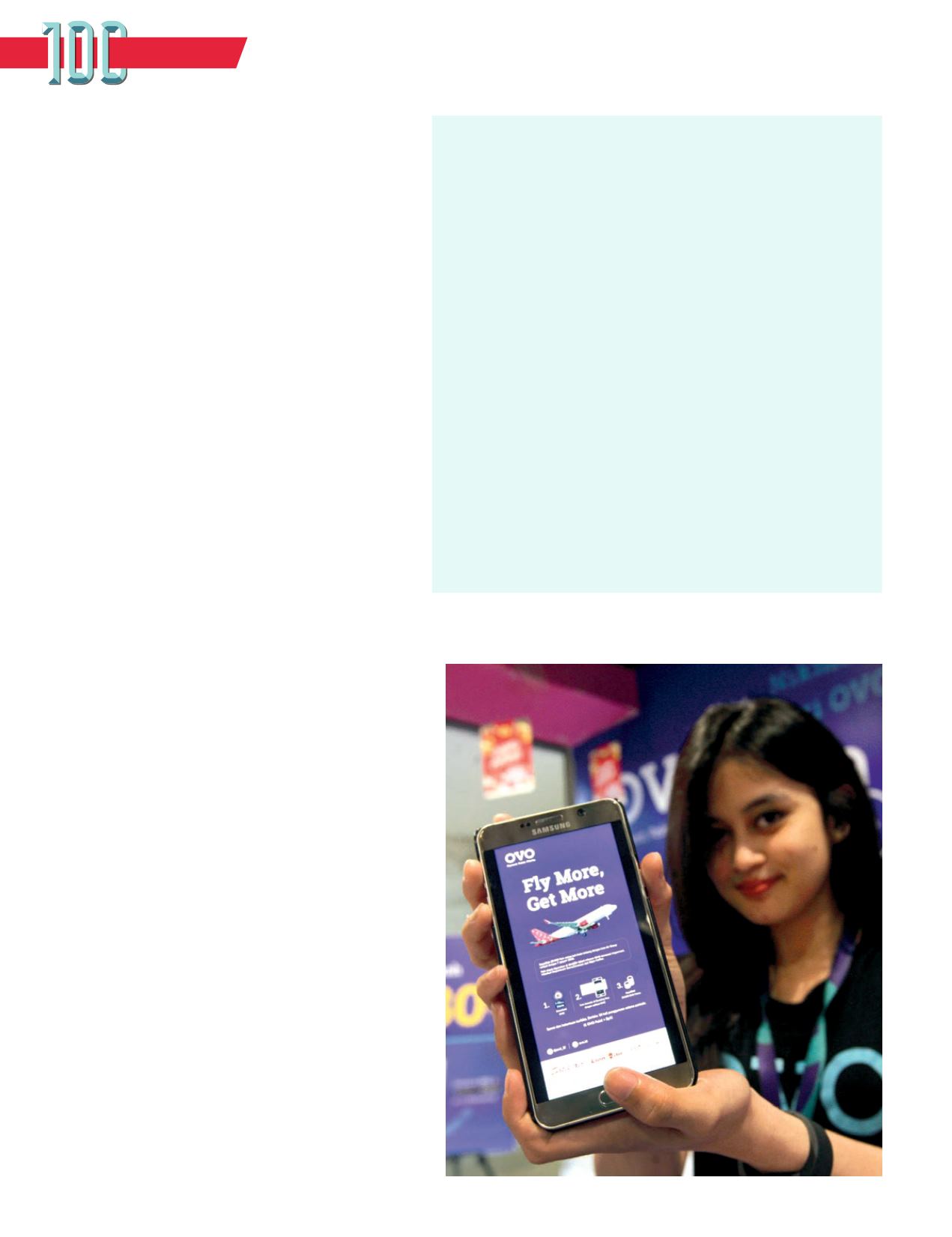

The Lippo Group has aggressively moved into the digital

economy, with among other initiatives, its OVO digital wallet and

payment gateway, which grew drastically, attracting around

18 million subscribers. As one of Indonesia’s most innovative

business groups, Lippo has a strong presence in almost every

consumer sector, including property, telecommunications,

health care, retail, entertainment, education, media and

technology. The group employs more than 130,000 people and

serves in excess of 100 million Indonesians annually. Its $6

billion Meikarta township development in Cikarang, West Java is

on schedule for completion in the first quarter of next year. Two

other major initiatives by the group this year are in health care

and technology. With more than 31 hospitals across Indonesia,

its Siloam Hospitals Group continues to expand and solidify its

leadership position in the market, while in technology, Lippo

is expanding into e-commerce and financial technology. The

group sets aside around $100 million per year for philanthropic

activities, which include scholarships for needy students from

remote parts of Indonesia.

6

Philip Morris International (Altria Group)

aka HM Sampoerna

Foreign/US

$7.1 billion

HM Sampoerna, Indonesia’s largest cigarette maker, contributes

the bulk of Philip Morris International’s business. With sales rising to

Rp 96 trillion in 2017 from Rp 95 trillion the previous year, the group

remains a market leader in Indonesia. There are around 90 million

smokers across the social spectrum in Indonesia, with hardly any

pressure on them to curb the habit. That is music to the ears of

Philip Morris, whose cigarette brands control around 40 percent

of the global market. Aggressive campaigns by the anti-tobacco

movement have so far failed to have anymeaningful impact and

the government is reluctant to make life difficult for an industry

employing millions of people in tobacco cultivation, cigarette

manufacturing and distribution. But this may change. On May 16,

the National Institute of Health Research and Development said

Indonesia loses at least Rp 500 trillion per year as a direct result of

smoking, far more than what the country gains in tobacco excise.

moh. defrizal/ga photo, Afriadi Hikmal/jg photo