37

august

, 2018

18

Barito Pacific Group

Private

Petrochemicals, forestry,

plantations

Prajogo Pangestu

$2.4 billion

Founded by Prajogo Pangestu

in 1979, the diversified group

controls Indonesia’s largest

petrochemical complex, Chandra

Asri, making it the biggest and

most integrated petrochemical

producer in Indonesia. Barito Pacific

is currently also expanding into

geothermal energy after the $755

million acquisition in July of a 66

percent stake in local geothermal

power producer Star Energy Group

Holdings Pte Ltd, which owns power

plants with a total capacity of 875

megawatts. The acquisition is seen

as a crucial move by the group to

establish itself as a market leader

in the renewable energy sector,

as well as increasing its capacity

through optimization. With planned

investment of $6 billion in several

projects between 2016 and 2021,

the group aims to generate more

revenue, stabilize corporate income

and become a power producer.

19

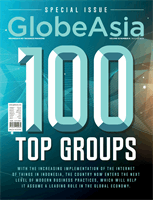

Qatar Investment Authority (Indosat Ooredoo)

Telecommunications, finance

Foreign/Qatar

$2.1 billion

Indosat Ooredoo, 65 percent controlled by the Qatar Investment Fund, has had a tough

year so far due to stiff competition in Indonesia, which saw the telecommunications

service and network provider posting a 22 percent year-on-year decline in revenue in the

first quarter. The company swung to a Rp 505.7 billion loss in the January-March period

after a Rp 173.9 billion profit in the corresponding period last year. Analysts say Indosat’s

internet connectivity offering did not measure up to those offered by competitors and that

it was therefore unable to improve average revenue per user. The company also has limited

funding available for network expansion. Indosat’s top management has made various

efforts to improve its financial performance, including sealing a cooperation deal with pay-

television operator Nexmedia.

20

Japfa Comfeed

Private

Animal Feed, property

Handojo Santoso

$2.1 billion

The group, jointly controlled by Handojo Santoso and Cargill subsidiary Black

River Asset Management, is focused on the production and sale of animal feed,

while it also operates Japfa Ltd., a Singapore-listed investment holding company.

Dairy-producing subsidiary AustAsia operates in China and Indonesia, marketing

products under the Greenfields brand. The group has experienced continuous

growth, with its shares having gained 27.03 percent by the middle of this year and

20.96 percent over the past full year. PT Japfa Comfeed, winner of the Top CSR

2017 Award, recently also participated in a search and rescue mission following

the tragic sinking of a ferryboat in Lake Toba, North Sumatra.

moh. defrizal/ga photo, reuters photo