31

august

, 2018

2

Salim Group/First Pacific/

Gallant Venture/Brantwood

Private

Food, telco, automotive, property,

infrastructure and mines

Anthoni Salim

$12.1 billion

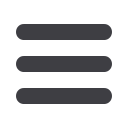

The Salim Group’s stronghold in the

consumer goods industry has prompted

it to enter the digital economy by

providing e-payment systems to

serve its network of 15,000 Indomaret

minimarkets. The group, which owns the

world’s largest instant-noodle maker, is

starting cooperation with Exxon Mobil

to distribute fuel for industry needs.

The group was expected to expand

into the poultry business early this

year, with an investment of about $200

million through its investment arm KMP

Private Limited, in cooperation with

Malaysia’s Cab Cakaran. In general, the

group posted solid growth compared

with the previous year with substantial

contributions from its consumer goods

and plantation businesses.

4

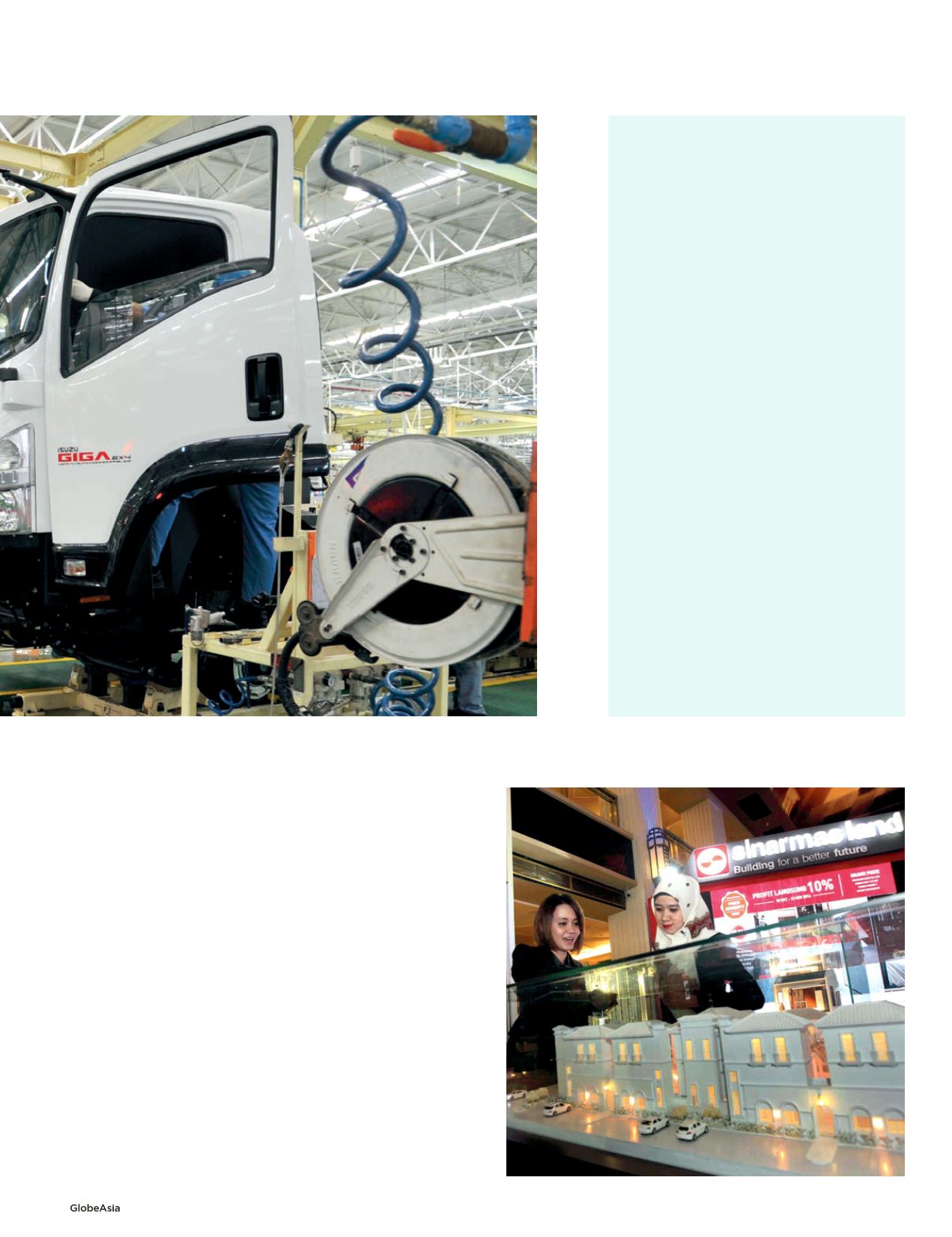

Sinar Mas Group

Private

Pulp and paper, agribusiness, energy, property, financial services

Eka Tjipta Widjaja

$8.7 billion

The Sinar Mas Group still earns a significant portion of its revenue

from resource-based subsidiaries SMART, SMART Agro, Asia Pulp &

Paper and associated companies. The group is also expanding into

property with a $500 million investment in its smart-city concept in

Bumi Serpong Damai in Tangerang, Banten. The group’s Sinar Mas

Land acquired the 33 Horseferry Road property in London, valued

at about $270 million. This move marks further expansion in the

European market, while the group also keeps an eye on China for

residential developments. Its financial arm Sinar Mas Multi Artha

has enjoyed significant growth in the banking and finance sectors

over the past three years. The group’s energy division is benefiting

from rising coal prices.