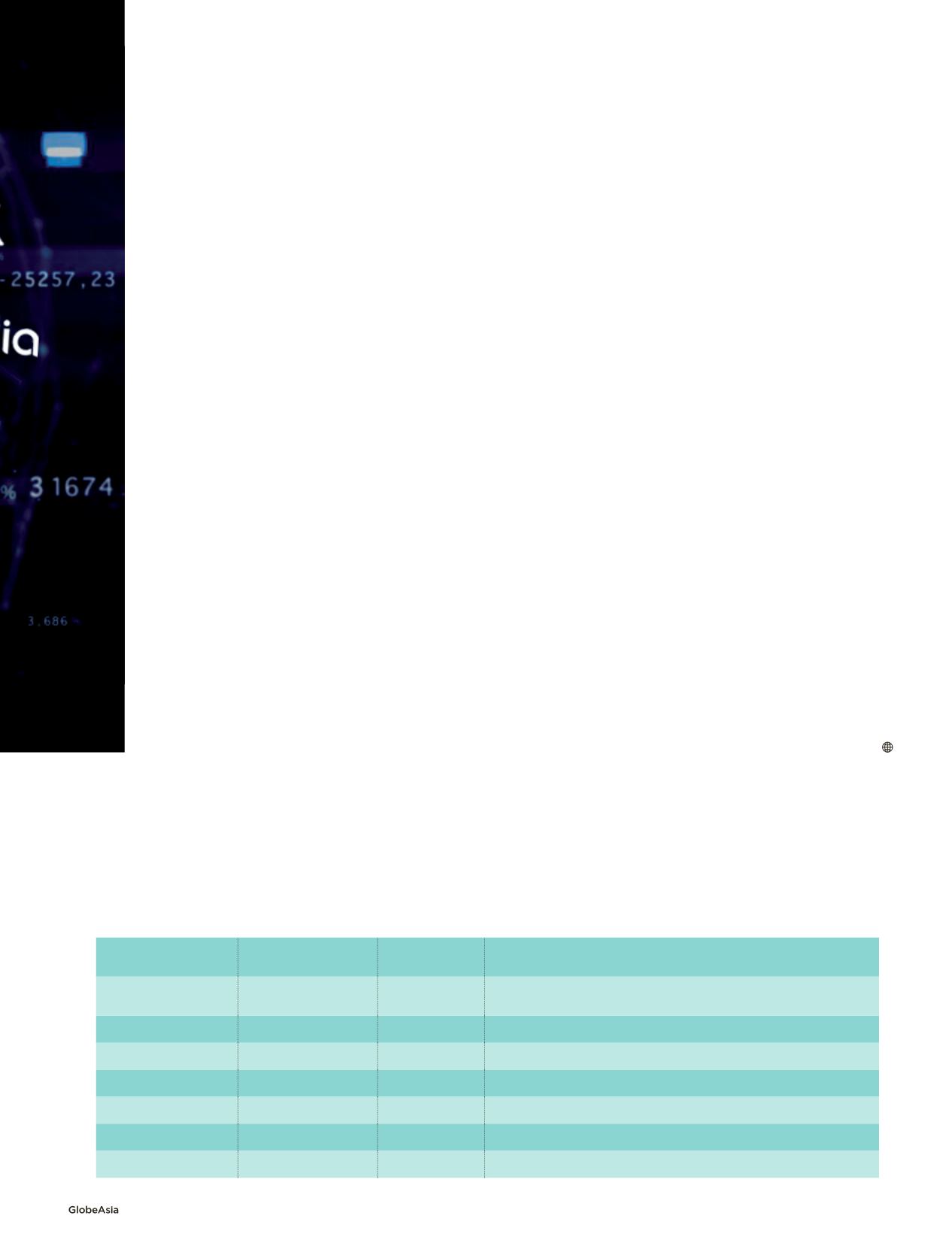

21

august

, 2018

Budi Hartono

Djarum

$935 million

Blibli.com,

Tiket.com,

Kaskus.com,GDP Ventures,

Kumparan, Gojek

Mochtar Riady

Lippo Group

$930 million

OVO, MatahariMall, Mbiz,

Venturra Capital (Ruang Guru, Grab, Sociolla, Zilingo)

Eddy Sariaatmadja Emtek

$795 million

Blackberry Messenger (BBM), Bukalapak, Dana, Doku, KLN

Patrick Walujo

Northstar Capital

$750 million

Gojek, Pasarpolis, NSI Capital

Jacob Oetama

Kompas Gramedia

$450 million

Skystar Ventures,

Kompas.comChairul Tandjung CT Corp

$275 million

Detik.comAnthoni Salim Salim Group

$175 million

Elevenia.co.id,

Indomarko.comFranky Widjaja

Sinarmas

$140 million

SMDV, Dimo

Value of Tycoons’ Investments in Digital Technology

The business landscape is now transforming to digital economy. Top Indonesian business leaders have

invested heavily in their respective tech startups, venture capital and e-commerce companies.

Taking a sectoral look at IoT, health care is one

area where this technology has seen the widest early

adoption to help hospitals diagnose patients in real

time and monitor their recovery. Indonesia’s national

health care program, with more than 90 million

participants, already uses this technology to process

troves of data.

The IOT also has many applications in the

aviation industry, where it is used to provide real-

time data on everything from performance of critical

aircraft components to maintenance schedules.

Interconnected networks of sensors and data hubs

at some airports also allow operators to track and

improve their understanding of passenger flow and

behavior.

Many Indonesian business groups have meanwhile

started to ramp up their investments in the digital

economy over the past five years, cognizant of the fact

that this technology will accelerate growth. Starting

with investment in diversified startups, these groups

have seen how the implementation of the IoT can

make operations in their brick-and-mortar stores

more efficient and most importantly, allow them to

respond to changing customer behavior as millions

now conduct their business transactions online.

Many business groups have invested large amounts

of money to acquire startups or establish their own

companies (see table). Indonesia’s Djarum Group and

Astra International invested in Go-Jek to strengthen

their businesses. Astra uses Go-Jek to boost its

marketing and sales, while Djarum provides customers

with easier payment methods.

The Lippo Group meanwhile, has entered the

digital era at an even higher level with the recent

signing of an agreement with Japan’s Softbank, which

is expected to give the Indonesian conglomerate a

major advantage over its competitors.

CoNsumptioN RemAiNs stAble

While the IoT is on the rise, optimism about the

local economy is still resilient. Despite a weakening

rupiah, slowing consumption and negative global

economic sentiment, listed companies saw an average

22.3 percent rise in net profit, compared with an

average rise of about 16 percent over the last decade.

At the same time, the number of local investors also

increased to around 40,000 actively trading every day.

The performance of companies in consumer

goods production and trade also remains stable,

with outstanding revenues and net profit growth.

Erajaya Swasembada, a company active in the sales

and distribution of telecommunication products, saw

revenue growth of more than 20 percent so far this

year, compared with to the same period last year.

The company also posted a 28 percent year-on-year

increase in net profit.

Consumer goods giant Indofood Sukses Makmur

of the Salim Group booked stable revenue growth of

between 6 percent and 8 percent over the past five

years, while Astra International, one of Indonesia’s

largest diversified conglomerates, also posted

significant sales growth (see table). Worth mentioning

is the banking and financial sectors, which despite

slow growth in credit disbursement over the past year,

still managed to grow faster than the overall national

lending industry.

These examples show that Indonesia’s

consumption remains positive despite some

adjustments. Rhenald Kasali, professor in management

science at the University of Indonesia, sees this trend

as a shift in customer behavior, with more shops

closing down as people increasingly turn to online

shopping. Among middle-come earners, luxury goods

purchases are no longer considered a matter of pride

and they now tend to spend more money on travel.